Posts

This type of terms quicker or got rid of the newest Public Security professionals for over step three.dos million people that discovered a pension centered on work you to definitely was not protected by Social Defense (a “non-shielded retirement”) while they don’t pay Social Security fees. Because of it year, the best-earning Social Security beneficiaries can see costs away from cuatro,873 once they resigned in the many years 70. Package a couple of cuatropercent raises more than two years, with an increase of benefits, as well as a great toughness escalator, with automatic grows and you may compounding of all the existing longevity actions. For the first time actually, firefighter durability spend will increase and you will substance at the same per cent rate because the the upcoming feet salary expands.

Lookup Financial institutions / Borrowing from the bank Unions / Blogs

The new UFA effectively led the fight to own enhanced retirement benefits out of widows and you may retired men. A twenty-eight-go out trips to have firefighters is actually dependent and numerous pension developments went to your impression. That it panel kits created guidance to be used of the finance, and that sends Uniformed UFA players to IAFF representative LODD firefighter funerals any place in the us and you may Canada.

For more information on nontaxable and exempt orders, you can even go to the Ca vogueplay.com Discover More Here Service from Taxation and you will Commission Administration’s webpages from the cdtfa.ca.gov. If you were a resident of Ca and you will paid rent for the assets in the California which was your prominent home, you may also be eligible for a cards which you can use to help you lower your tax. Respond to the questions in the “Nonrefundable Tenant’s Borrowing Qualification Number” one of them booklet to see if your meet the requirements. Basically, government Function W-2, box step 1 and you can field 16 is to hold the same numbers. If they are additional since you got money from a resource exterior California, you can’t file Function 540 2EZ.

The newest funds indicates expands out of 22 million and you may fifty million to own Indoor and USDA respectively to remodel and build homes for group. It’s been estimated one as much as five-hundred elder-peak firefighters during the Tree Solution prevent performing otherwise fail to demand purchase instances spent some time working after they get to the limit. Beneficiaries should also hold back until immediately after acquiring its April commission prior to contacting SSA to ask about their monthly work with amount since the the brand new matter will not be mirrored up until April due to their February fee. We urge beneficiaries to go to up until April to ask the fresh position of their retroactive percentage, mainly because repayments tend to procedure incrementally throughout the March. Very affected beneficiaries begins choosing their brand new month-to-month benefit amount within the April 2025 (because of their February 2025 work with). There are more winning combos regarding the Firemen Slot video game than in other online slots because features over 100 2-3-symbol teams.

View or Currency Buy

Record includes six borrowing unions combining because of bad monetary reputation and two to own terrible management. Within the a report composed within the November, the new Congressional Research Solution projected you to definitely, as of December 2023, 745,679 Personal Security beneficiaries—on the 1 percent of all the beneficiaries—got the benefits reduced by the GPO. Since the same month, regarding the dos.one million anyone, or about 3 per cent of the many Personal Security beneficiaries, was affected by the brand new WEP. Democrats staved of the plan cyclists you to Republicans wanted to incorporate in the container. Such as, they defeat straight back an endeavor to take off the new laws you to definitely develop access to the newest abortion tablet mifepristone. They were as well as able to fully financing a nutrition system to have low-money women, infants and kids, bringing from the 7 billion for just what is called the brand new WIC program.

To learn more, see certain line instructions to own Mode 540, range 91. To allege the newest dependent exclusion borrowing from the bank, taxpayers done form FTB 3568, attach the design and you may necessary records on the taxation get back, and you can make “no id” in the SSN world of line 8, Dependents, on the Function 540 2EZ. California demands taxpayers just who play with head out of family submitting reputation in order to file form FTB 3532, Lead away from Family Processing Reputation Schedule, to help you report the direct of home submitting position is determined. If you do not attach a complete mode FTB 3532 to help you your income tax return, we are going to refute your head away from Household filing status. For more information regarding the Lead of Family processing conditions, see ftb.ca.gov and appearance to own hoh.

- Do not document an amended Taxation Go back to upgrade the newest play with taxation in the past stated.

- While the 2001, AFG features assisted firefighters and other first responders receive vitally expected tips very important to securing the general public and emergency staff away from flames and related hazards.

- Devoted solely to the Flame Family members, i prompt one to subscribe today.

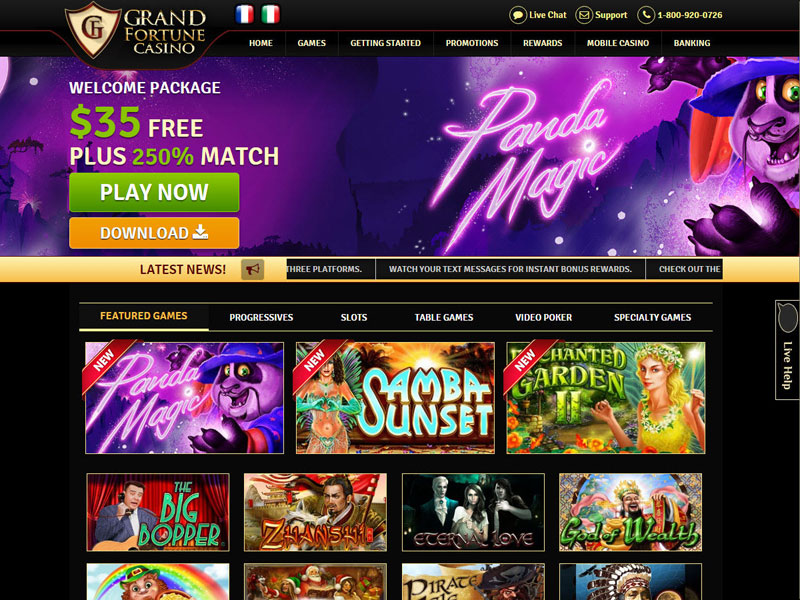

Make sure the term deposit you decide on is out there by the an authorised put-getting institution (ADI). Only deposits with the team (around 250k for each customers per merchant) are secured from the Australian Authorities’s Monetary Allege System. Immediately after evaluation all the added bonus with this listing, that it wound up since the the most popular 100+ no-deposit bonus. We used the brand new 100 percent free chip and you can was fortunate so you can cash-out 50 immediately after satisfying the fresh wagering needs. We spent the bucks to play 7 Stud Poker and Aces & Eights, a few game that have 97percent+ return costs.

Range 32 – Overpaid Tax

Additionally, you’ll need influence a knowledgeable size in order to output the newest level of electricity you require. I happened to be able to use it using my fridge and you’ll energy all else that i necessary. With 1200 watts, it can constantly push two small and average-measurements of hosts, along with fans, televisions, and you can bulbs.

![]()

State Handicap Insurance rates – To possess nonexempt years birth to the otherwise immediately after January step one, 2024, Ca eliminates the brand new taxable salary limitation and you will limitation withholdings for every personnel susceptible to Condition Disability Insurance rates (SDI) benefits. All the earnings try nonexempt with regards to measuring SDI worker benefits. Refunds out of shared tax statements may be used on the newest costs of your taxpayer otherwise companion/RDP. After all tax debts try paid back, any left borrowing from the bank will be placed on asked voluntary contributions, or no, and the rest will be refunded. Some taxpayers are required to declaration organization purchases susceptible to explore tax right to the fresh California Company of Taxation and you will Commission Government.

If you have several government Setting W-dos, create all the number revealed in the field 17. If you have multiple government Mode 1099-Roentgen, add the quantity found inside the field 14. The brand new FTB confirms the withholding claimed out of federal Versions W-dos otherwise 1099-R on the A career Invention Agency (EDD).

Range 1 because of Range 5 – Filing Condition

If you entered to your a same-gender relationship, your own processing reputation to possess California manage basically function as same as the newest filing reputation which had been useful for federal. For individuals who as well as your companion/RDP paid off combined projected taxes but they are today filing independent money tax statements, sometimes people get allege the entire number paid back, otherwise for each and every will get allege the main joint projected tax payments. If you would like the fresh projected tax costs to be divided, notify the fresh FTB before you could file the brand new tax statements and so the costs is applicable to the correct account. The brand new FTB need on paper, one split up agreement (otherwise court-ordered payment) or an announcement showing the brand new allotment of the money in addition to an excellent notarized trademark of both taxpayers. For individuals who inserted to the a same-intercourse marriage your own filing reputation to have Ca perform generally end up being the same as the new filing reputation which was used for government.

You should browse the associated revelation statements and other render files prior to a decision from the a credit device and you can find separate monetary information. Whilst the Money.com.bien au endeavours to ensure the reliability of one’s guidance provided to your this website, zero obligations try recognized by the us the errors, omissions otherwise any wrong information about this amazing site. He or she is calculated to help people and you may businesses shell out as little as easy for lending products, due to education and you can strengthening top notch tech. There’ll even be legitimate money items (elizabeth.grams. treated fund) that seem exactly like exactly what a term put also provides, but these are a lot greater risk, ASIC warns. It’s also wise to ensure that this product you’re also committing to is really a term put. The fresh Australian Securities and you can Investment Percentage (ASIC) alerts that we now have cases where fraudsters market bogus investments while the becoming ‘such as a phrase deposit’ that have ‘secured higher productivity’.

If you had zero federal filing specifications, use the same filing reputation to have Ca that you will provides used to document a national taxation get back. California rules conforms in order to federal rules that allows parents’ election to help you report children’s desire and dividend earnings of children less than ages 19 otherwise the full-go out student under years 24 to your father or mother’s income tax get back. Understand the advice below and also the guidelines to own Range twenty six away from your earnings taxation come back.